The Wheel trading strategy is among the leading solutions to make revenue via gathering premiums. Before talking about a wide range of choices trading strategy, this could perhaps assist in learning from scratch.

I do not want to suppose that each investor understands how to trade a lot of choices contracts. In short, I might introduce several ultimate choices terms so that you can gain a deeper insight into the wheel trading strategy.

What is the Wheel Trading Strategy?

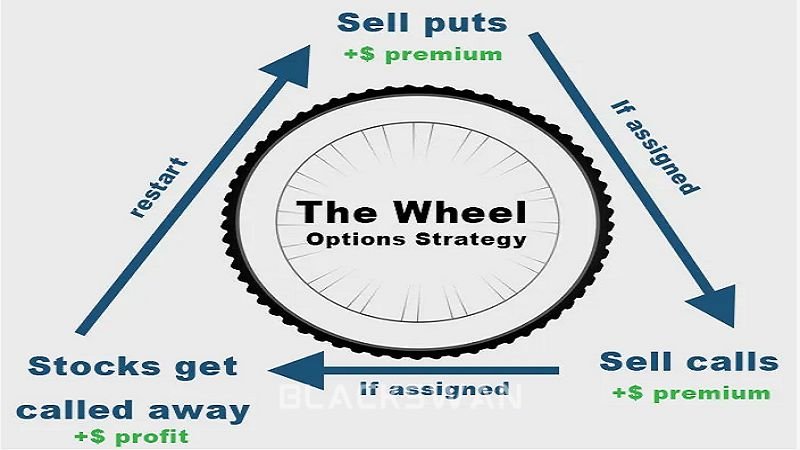

The wheel strategy is called the “Wheel Trade” or straightforwardly “The Wheel”, is a wide range of choices trading strategy which relates to making use of a mixture of put options and covered call options to make income and get stocks at low cost.

That strategy is regularly used by investors who get the neutral to mildly develop optimism with a specific stock. In addition, the strategy targets capitalizing by making income from option premiums when even getting stocks if specific circumstances are suited.

The target of the wheel trading strategy is to make a stable income from selling put and call options when obtaining stocks at low expense. It is crucial to highlight that this strategy asks intensive stocks’ consideration you opt for, and an entire insight into options trading and even potential risks.

When it comes to trading strategy, there are more risks such as the loss of possibility if the stock price fluctuates with unwanted directions. Traders taking the wheel strategy might get a sturdy insight into choices, market trends, and the particular stocks they want to trade.

It is highly suggested to teach your own entirely and get a consultation by a financial advisor before executing the choices trading strategy.

How does the Wheel Trading Strategy Operate?

The objective of the wheel strategy is to make income via a variety of options premiums and obtain stocks at affordable prices. Traders executing the wheel strategy might get a better insight into options trading, market analysis, and risk control. That’s even a great initiative, to begin with paper trading or a small position before committing considerable capital.

On top of it, the wheel option trading strategy takes advantage of a mixture of trades to gather premiums. You can get approximately $10,000 in cash, and additionally a margin to acquire the ideal outcomes. For instance, TNA, MSFT, and AMZ are the leading stocks for the wheel strategy.

Before executing the stock wheel strategy, you need to concentrate on the top primary trades such as

– Sell out the money put

– Obtain the share

– Sell a covered call with these shares

This can assist with the money sale to execute the wheel trading strategy. If you possess the option with the leak price or before the expiration date, you get the right but might not face a legal obligation to keep the security.

Besides, you need to take a premium when selling a placement option that you want to hold no matter how the purchase result is.

How to Trade the Wheel Strategy?

Trading the wheel strategy relates to a chain of steps to implement the strategy. In other words, this part shows you how to use the wheel strategy effectively.

1. Stock selection

Opt for stocks that you might love owning for a long period. Concentrate on basically sustainable corporations that relate to your investment targets. Search for stocks with sustainable efficiency and price stability records.

2. Selling cash-secured puts

First, you need to determine the stock you want to obtain. Identify a peak price with the put option which is under the available market price, but at the level in which you can own the stock. Next, sell the cash-secured put option by setting the order via your platform. Finally, gather the premium upfront.

3. Control put option expiry

If the stock price keeps higher than the put option’s strike until the expiration date, the put option can expire worthless. In case the put option is exercised, you need to be obligated to purchase the stock at the peak price.

4. Owning the stock

If the put option is exercised, you will be assigned as the owner of the stock. Evaluate the stock available circumstance, and your market trends.

5. Selling covered calls

It is crucial to determine a peak price with the call option which is higher than the available market price. Next, sell the covered call option by making an order via your platform. Lastly, gather the premium from selling the call option.

6. Control the covered call expiry

If the stock price keeps under the call option’s peak price until the due date, you might keep the premium. Next, you might sell the stock at the peak price when the call option is exercised.

7. Do this phase again

If the covered call expires unexercised, you have to take into consideration selling the cash-secured put option to start the phase again. If the covered call is exercised, you might kick in the phase-over by selling the new cash-secured put option.

Best Practices and Tips for Wheel Strategy

Executing the wheel strategy productively requires a sturdy insight into options trading, risk control, and market trends. Let’s take a look at some practices and tips below.

1. Stock selection

– First, opt for basically sustainable stocks with a record of consistent performance.

– Prevent speculative stocks that might result in losses.

2. Risk Control

– Sell put options with stocks you want to own at the peak price.

– Make sure you get enough cash in your account.

3. Option selection

– Opt for strike prices with put options which are under the available market price

– When it comes to covered calls, stick to the strike prices higher than the available market price

4. Time horizon

– Acquire a long-period view when applying the wheel strategy

– Prevent short-term thought and hold above stocks if possible

5. Diversification

– Diversify the wheel strategy positions through various stocks

– Do not focus on the trades with a stock

6. Market analysis

– Keep updated with market trends and events

– Customize your strategy up to transforming market circumstances.

7. Exit strategies

– Get clear exit strategies with put options and covered calls.

– Customize or close positions if the market goes towards your expectations.

8. Profit purposes and loss limits

– Establish real profit targets for put options and covered calls

– Identify at what point you might focus on a position a loss

9. Rolling options

– If the put option is exercised, concentrate on rolling it to the later expiration date.

10. Practice and Education

– Kick in paper trading or small positions to acquire experience.

– Keep on educating on your own about options trading and risk control.

Frequently Asked Questions

You will acquire more knowledge about the wheel trading strategy after reading this section. Let’s go with me for the precious information below.

1. Is the wheel trading strategy profitable?

Sure. The wheel trading strategy might be profitable. This takes an overall approach of selling puts and calls to make significant income via premiums.

2. Does the wheel trading strategy deserve investing in?

The wheel strategy relates to the systematic procedure and is seen as a secured approach to options trading. It is deserved for traders hunting sustainable income with minimum risk.

3. Could you tell me an illustrated example of the wheel strategy?

The wheel strategy’s example can help you sell the cash-secured put option with a particular property with a chosen strike price. When the shares are assigned, sell the covered call at a new peak price. In a situation where the shares are called away, get back to selling the cash-secured put.

4. Is the wheel trading strategy secured?

The wheel options strategy is a good income-making strategy which I have talked about above. However, it may be risky in some stages of the wheel.

5. Can I lose money on the wheel strategy?

The wheel strategy is an excellent options trading strategy, but there is a primary risk. It is when you want to assign the stock, and the stock goes on falling. In this circumstance, you might face a big loss.

Final thoughts

In short, the wheel trading strategy is a technique that relates to cycling via the call options. That approach might enhance benefits to people related to crypto trading, permitting capitalization with the crypto price movements, and controlling risks significantly.